The manufacturing recovery has begun but is it sustainable?

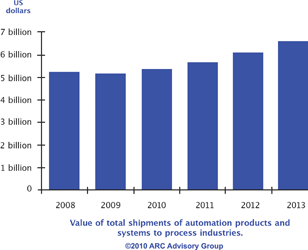

Automation supplier revenues continued to fall throughout 2009 as compared to 2008. ARC expects that year-on-year comparisons between 2008 and 2009 will experience a decline, with modest growth in 2010. ARC sees signs that the manufacturing recovery has begun but its continued success depends on the ability of the financial markets to return to normal functioning. Small, medium, and large businesses have all been strained by the inability to access short-term capital. Moreover, many businesses have simply delayed capital equipment expansions, particularly if they manufactured components in the automotive supply chain.

Although the short-term forecast for the global automation expenditures for the process industries looks bleak, ARC expects moderate market growth to resume during the latter part of the five-year forecast period. Once the economic turmoil settles, the globalisation environment will resume, which will once again cause manufacturing companies to invest in capital expenditures. “Manufacturers will continually face challenges to raise productivity, lower product costs, reduce plant operating expenses, and increase return on investment (ROI) to compete in the global market. Consequently, capital investments for automation should resume across many industries,” according to David Clayton ([email protected]), the principle author of ARC’s ‘Automation Expenditures for Process Industries Worldwide Outlook’ (www.arcweb.com/res/auto-process).

Downward pricing pressure accelerates

It is not often that price erosion becomes a major concern in the automation sector. However, industry veterans have experienced double-digit price decreases. There are several reasons for this, but the net effect is that the market will have difficulty growing even in the high single-digit range over the next five years. One element contributing to the price erosion is that controllers are rapidly becoming an automation commodity in some sectors. Differentiation between products, capabilities, and performance factors is rapidly diminishing. A large percentage of the suppliers in the market can compete very effectively from a performance criterion across many markets. This increases price competition.

Increase services component of business

With the commoditisation of control equipment, many automation suppliers are differentiating themselves by broadening the scope of services offered to include front-end engineering and design, operations, out-sourced maintenance, and performance improvement. Users and suppliers alike benefit from a more collaborative relationship. Users can leverage the expertise of suppliers to help manage plant assets across their entire life-cycle. Suppliers can go beyond being just automation providers, enhance their overall project revenues, and enjoy long-term revenue streams through customer service relationships.

With the global economic uncertainty and ongoing lack of consumer demand, manufacturers are putting more thought into whether they should replace or simply repair their automation equipment. Since automation repairs are often less expensive than replacement, it is reasonable to expect to see a jump in repair business during an economic slowdown. To take full advantage of this opportunity, suppliers should make sure that they are in a position to provide repair and maintenance services, not just on their own products, but also on products manufactured by other suppliers.

Leverage high growth global regions

To take full advantage of the relatively high level of industrial and infrastructure growth in regions, such as China, India, the Middle East, and Eastern Europe, suppliers should continue to invest in improving their distribution channels, including production facilities, sales, service, and repair locations in developing regions. This can open new markets for conventional and low-cost automation options, breathing new life into these older-generation products, which have been steadily declining as sales of intelligent solutions continue to grow.

Leverage emerging growth industries

The change in leadership in America, dwindling oil and gas reserves, and environmental concerns are providing an environment ripe for alternative fuels. Revival of the nuclear industry and LNG liquefaction and gasification plants, commercialisation of clean coal and cellulose ethanol are all possible. Suppliers should keep abreast of these markets by helping them solve measurement problems with industry specific solutions.

For more information contact Kimberly Coffman, ARC Advisory Group, (+1) 781 471 1123, [email protected], www.arcweb.com

© Technews Publishing (Pty) Ltd | All Rights Reserved